Documents & Tools

Documents & Tools

School Finance Fact Check

Let’s set the record straight about some recent claims regarding state investments in Texas public schools.

Vouchers make recapture worse

When Texas pays to send students to private schools, Robin Hood takes a bigger bite out of local public schools.

Prepayment Discount for Recapture

Credit incentivizes early payment and offers relief from record-high recapture

Issues in Focus: Taxparency

Taxpayers should know where their tax dollars go.

Issues in Focus: Recapture

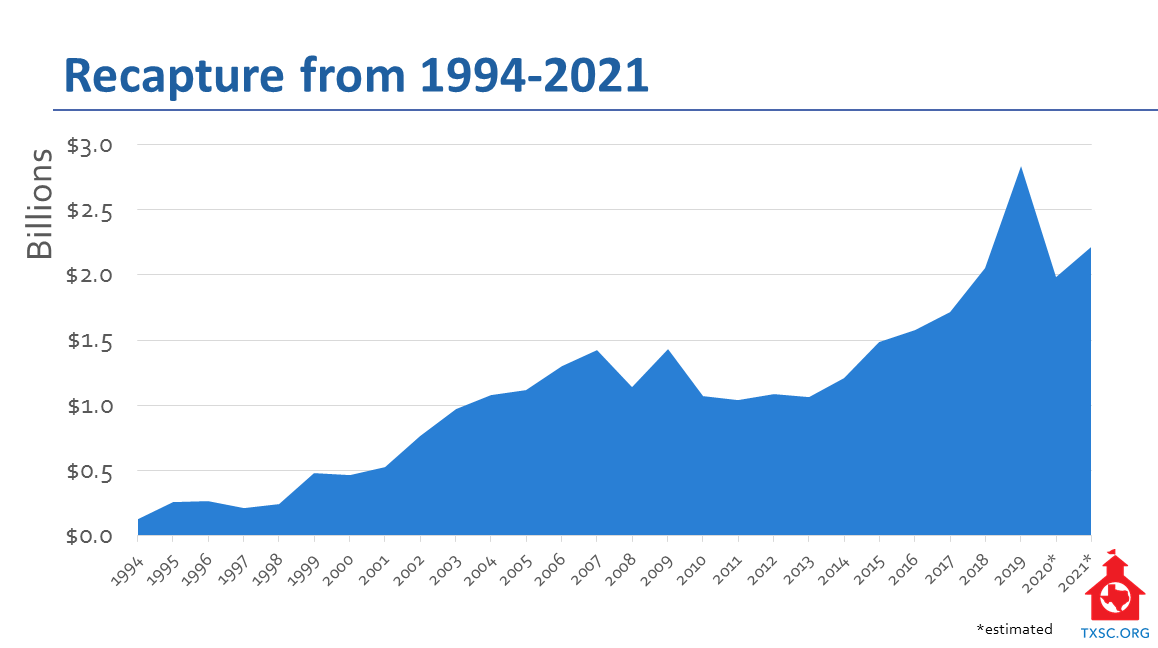

The State of Texas is taking record amounts from school districts through recapture.

Per-Student Funding & Inflation

State investments will help enable public schools to meet students’ needs.

The Shell Game

Learn how the legislative appropriations process has become a “shell game” when it comes to Robin Hood recapture.

Private-school Vouchers

Public tax dollars should fund public schools that have clear systems of academic and fiscal accountability.

Sustainable Funding for Schools

Lasting investments in Texas students —the state’s future workforce — will help ensure future economic success.

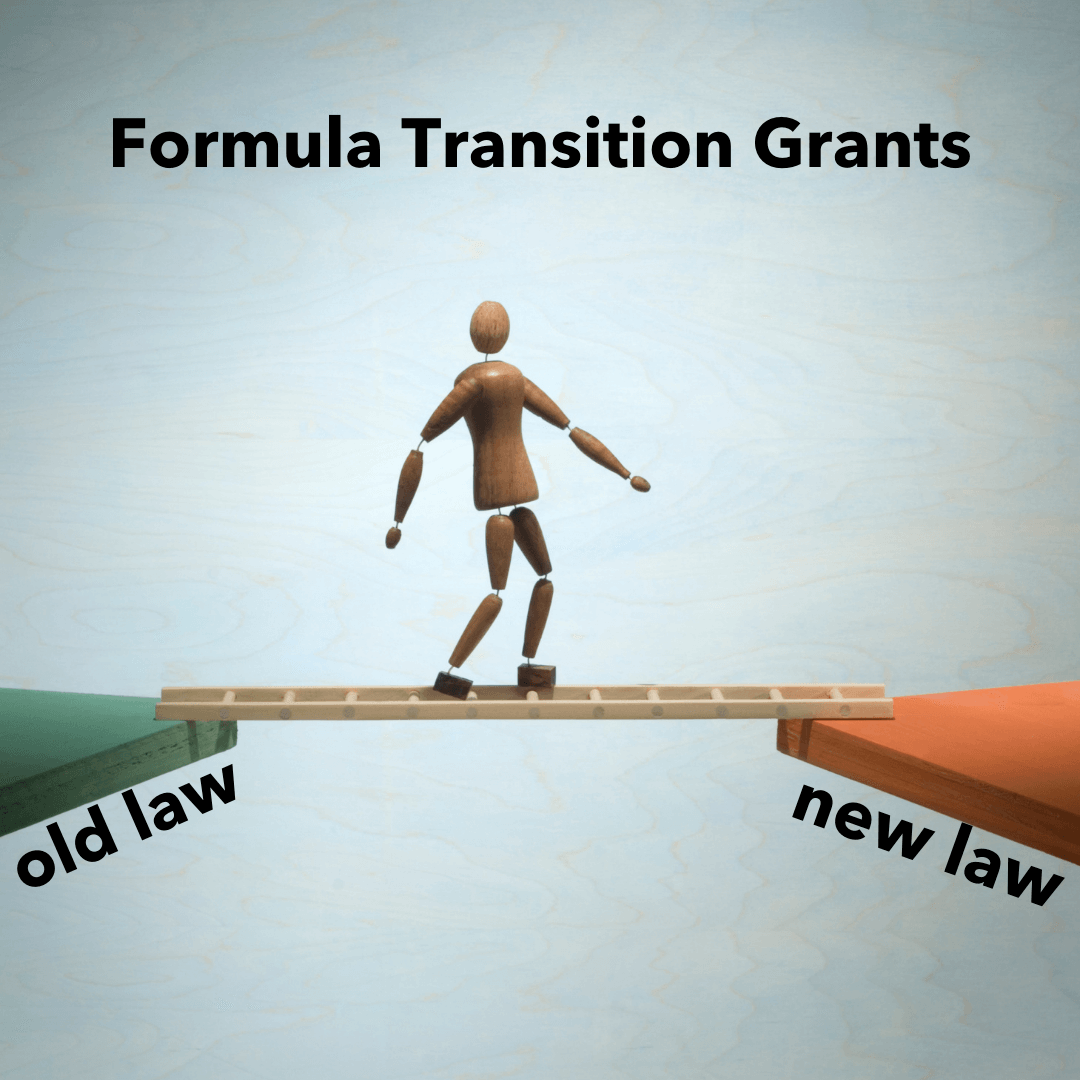

Formula Transition Grants

Coming expiration of short-term grants threatens education funding.

School Finance testimony in House

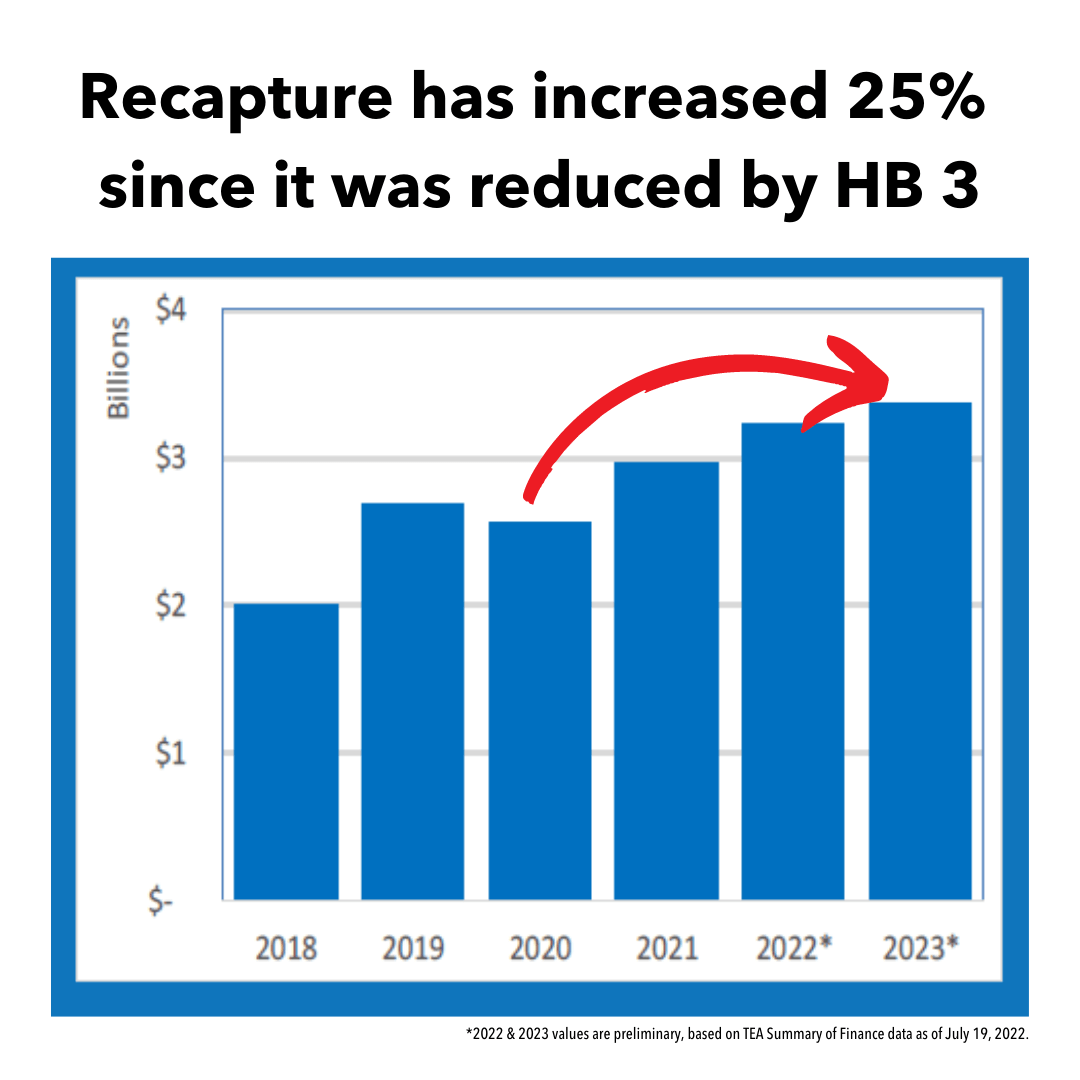

The Coalition provided testimony to the House Public Education Committee on school finance. Since HB 3, inflation has increased by 12%, while school funding has been flat. Since recapture was reduced by HB 3, it has increased by 25%.

School Finance testimony in Senate

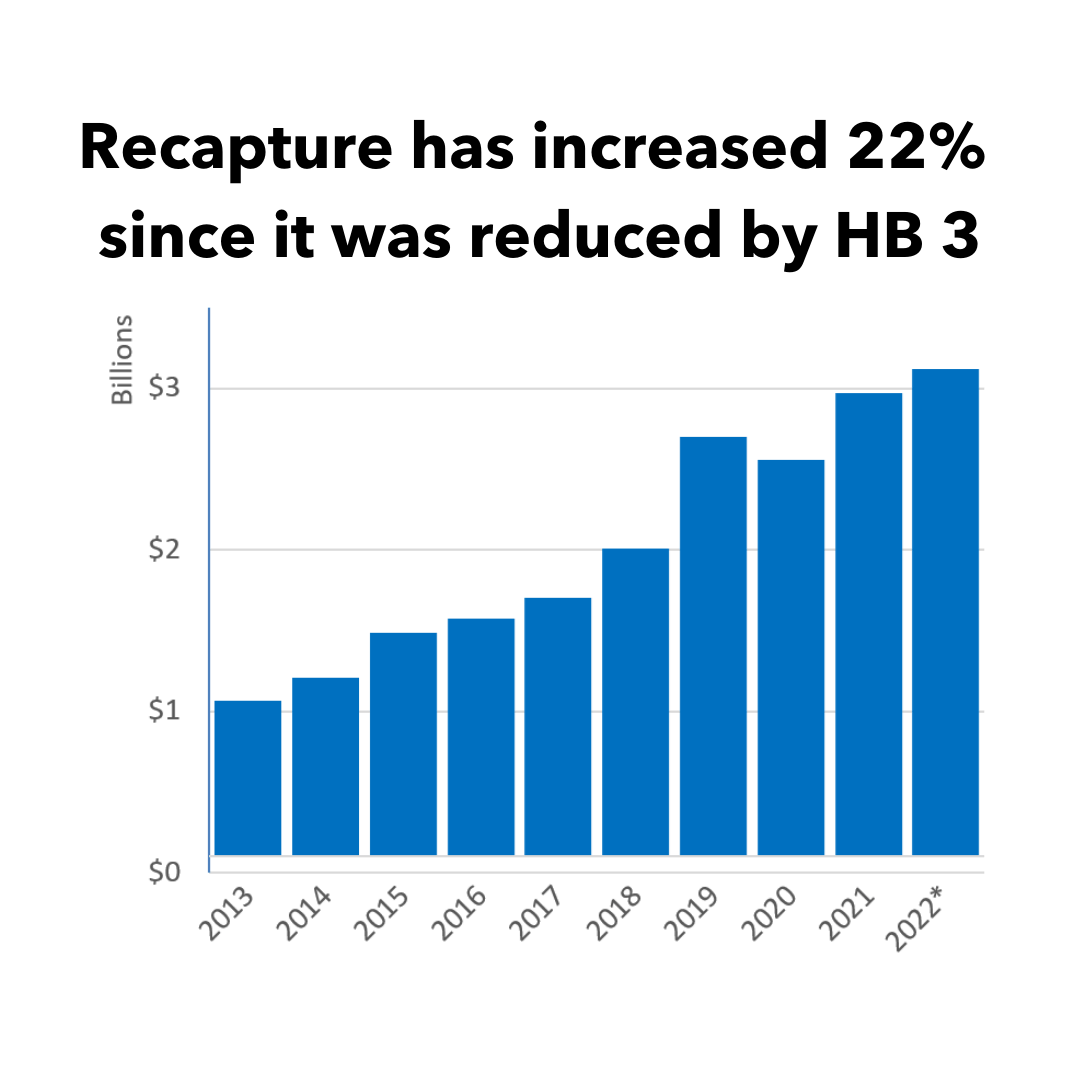

The Coalition provided testimony to the Senate Education Committee on school finance. Since HB 3, inflation has increased by 9%, while school funding has been flat. Since recapture was reduced by HB 3, it has increased by 22%.

School Funding Still in Need of Improvement

Some people have recently tried to downplay the impact of recapture on schools and taxpayers by saying the State and the federal government have already made sizable investments to help our schools. These points are recommended to provide some important context and facts.

CSHB 1525 Threatens Funding for Public Schools

House Bill 1525 is billed as the “clean up” measure that addresses unintended consequences of school finance reforms passed in 2019. However, the Senate version of HB 1525 goes much further and could lead to funding reductions for many school districts. It would also severely limit districts’ ability to use federal education funds as intended.

Formula Transition Grant Prevents Funding Losses

The House Bill 3 school finance legislation passed in 2019 invested billions of new dollars in public education, but the new law’s changes to funding formulas left some districts with less funding. The Legislature put Formula Transition Grants in place to ensure districts received a minimum increase. FTGs make the law adopted in 2019 better than the law we had before; without it (or with it at a reduced amount), that isn’t the case.

What schools need to know about ESSER 3

On April 28, 2021, state leaders announced that the entirety of the $11.2 billion from the LEA allocation under ESSER III would flow to Texas schools. This post is intended to focus specifically on what district leaders need to know about the ESSER III allocation for school districts.

Fund Balances Help School Districts Manage Resources

In simple terms, fund balance is the difference between assets and liabilities in a governmental fund as of the close of the fiscal year. School districts use their fund balances to responsibly manage cash flow — especially in districts that pay recapture and cannot lean on regular state funding.

Federal Relief Funds: Schools Left Waiting as Texas Stalls

Rather than trying to determine how to distribute federal dollars to the schools that need them, Texas is trying to withhold them. Some 40 states have started distributing dollars to their schools, but Texas has not.

Preserve local control and flexibility

Locally elected school boards should have the flexibility to make decisions that are best for their communities’ unique needs.

COVID-19’s Impact on Education

The coronavirus pandemic has had a profound impact on public education in Texas, and it will take years to overcome that impact.

After challenging year, support for public schools is critical

In order to meet the state’s future workforce needs and give all Texas children the opportunity to succeed, it is critical that the state continue to invest in public education.

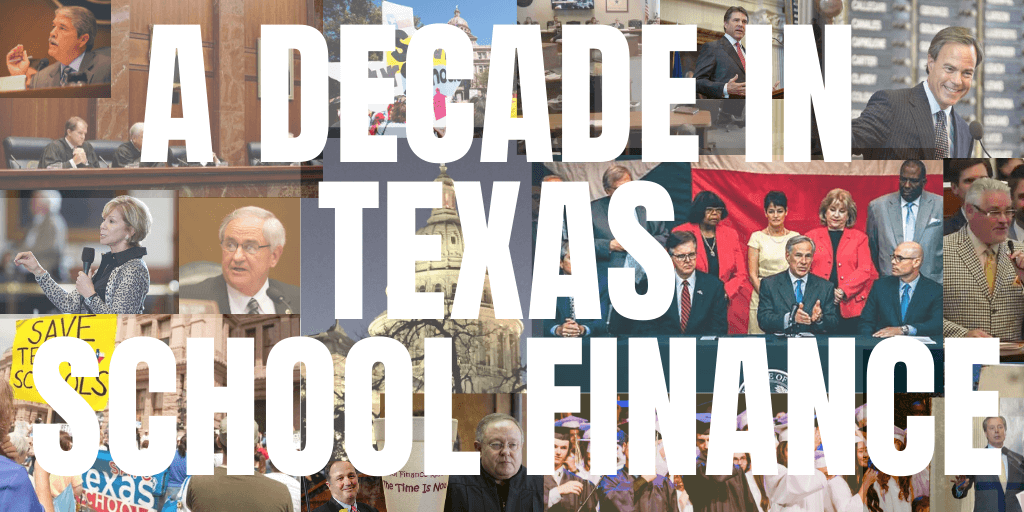

School Finance Overview

The Past Decade in Texas School Finance

Over the course of the last 10 years, the Texas Legislature has at times made investments in public education and, during struggling economic times, reduced education funding. The decade began…

Texas School Finance FAQs

How big is the public education system in Texas? More than 5.4 million children attend Texas public schools and more than 720,000 people work in public education in Texas, including…

School Finance Reforms Didn’t Reduce Recapture for Everyone

School finance reforms enacted in 2019 reduced recapture statewide Recapture (also known as “Robin Hood”) is the process by which the state takes some of the local property-tax revenue collected…

Recent Presentations

The Texas School Coalition used the following documents in presentations to member districts and other groups: