Download Key Messages on HB 2

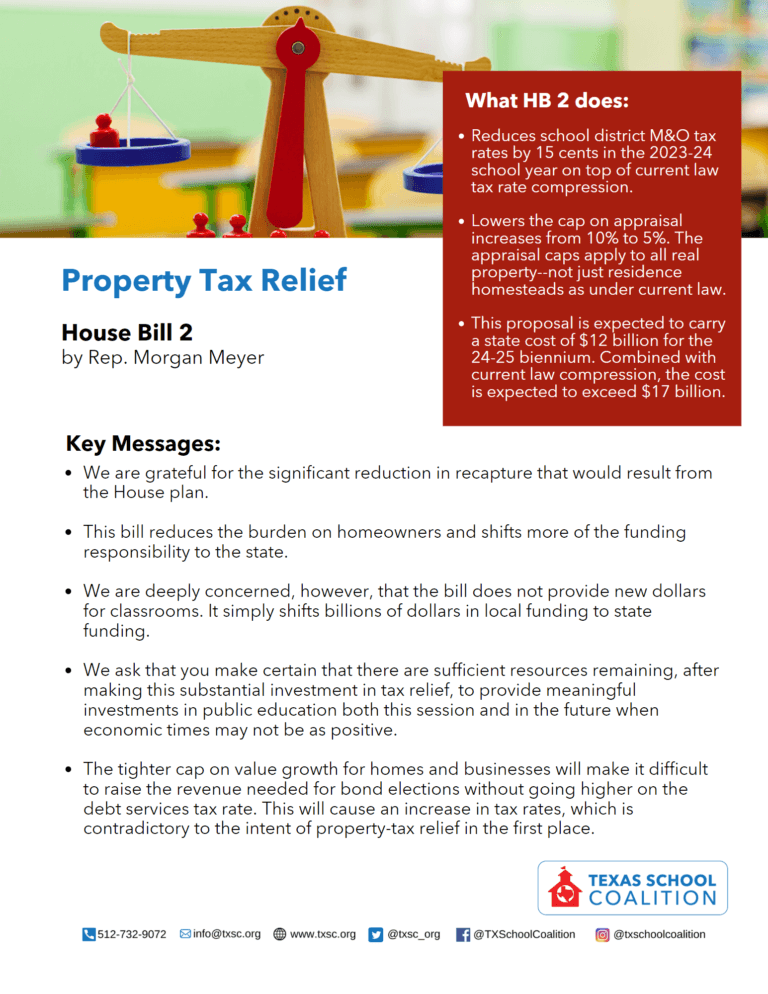

- We are grateful for the significant reduction in recapture that would result from the House plan.

- This bill reduces the burden on homeowners and shifts more of the funding responsibility to the state.

- We are deeply concerned, however, that the bill does not provide new dollars for classrooms. It simply shifts billions of dollars in local funding to state funding.

- We ask that you make certain that there are sufficient resources remaining, after making this substantial investment in tax relief, to provide meaningful investments in public education both this session and in the future when economic times may not be as positive.

- The tighter cap on value growth for homes and businesses will make it difficult to raise the revenue needed for bond elections without going higher on the debt services tax rate. This will cause an increase in tax rates, which is contradictory to the intent of property-tax relief in the first place.