KEY POINTS TO REMEMBER:

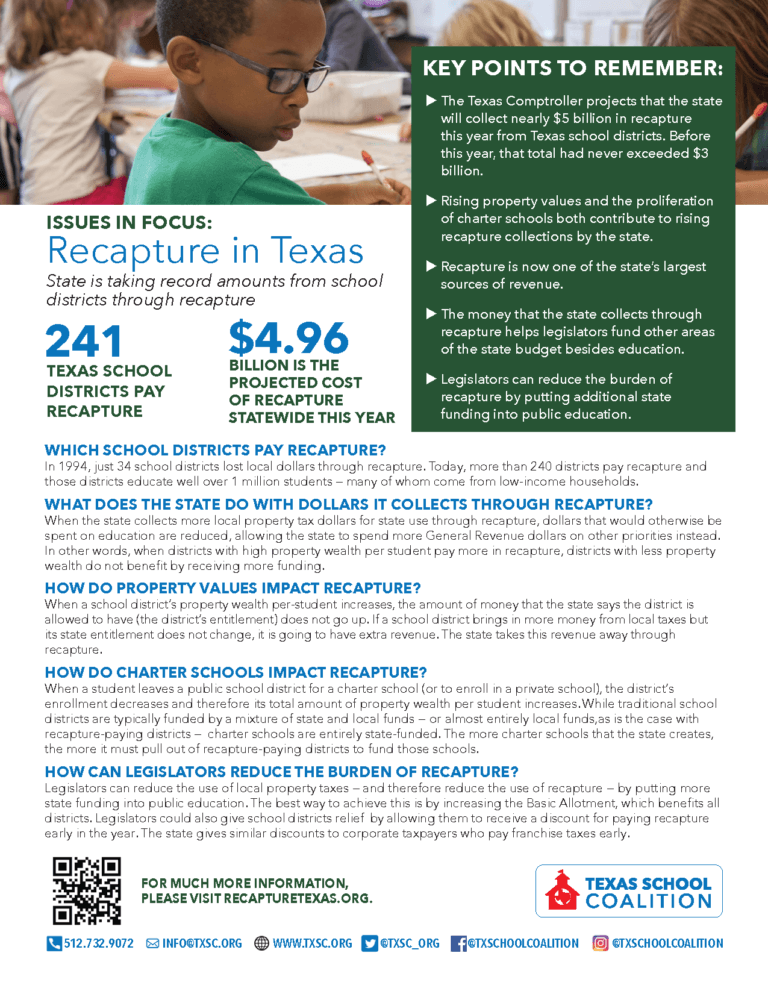

- The Texas Comptroller projects that the state will collect nearly $5 billion in recapture this year from Texas school districts. Before this year, that total had never exceeded $3 billion.

- Rising property values and the proliferation of charter schools both contribute to rising recapture collections by the state.

- Recapture is now one of the state’s largest sources of revenue.

- The money that the state collects through recapture helps legislators fund other areas of the state budget besides education.

- Legislators can reduce the burden of recapture by putting additional state funding into public education.

WHICH SCHOOL DISTRICTS PAY RECAPTURE?

In 1994, just 34 school districts lost local dollars through recapture. Today, more than 240 districts pay recapture. More than half of the students in those districts come from low-income households.

WHAT DOES THE STATE DO WITH DOLLARS IT COLLECTS THROUGH RECAPTURE?

When the state collects more local property tax dollars for state use through recapture, dollars that would otherwise be spent on education are reduced, allowing the state to spend more General Revenue dollars on other priorities instead. In other words, when districts with high property wealth per student pay more in recapture, districts with less property wealth do not benefit by receiving more funding.

HOW DO PROPERTY VALUES IMPACT RECATPURE?

When a school district’s property wealth per-student increases, the amount of money that the state says the district is allowed to have (the district’s entitlement) does not go up. If a school district brings in more money from local taxes but its state entitlement does not change, it is going to have extra revenue. The state takes this revenue away through recapture.

HOW DO CHARTER SCHOOLS IMPACT RECATPURE?

When a student leaves a public school district for a charter school (or to enroll in a private school), the district’s enrollment decreases and therefore its total amount of property wealth per student increases. While traditional school districts are typically funded by a mixture of state and local funds — or almost entirely local funds, as is the case with recapture-paying districts — charter schools are entirely state-funded. The more charter schools that the state creates, the more it must pull out of recapture-paying districts to fund those schools.

HOW CAN LEGISLATORS REDUCE THE BURDEN OF RECATPURE?

Legislators can reduce the use of local property taxes — and therefore reduce the use of recapture — by putting more state funding into public education. The best way to achieve this is by increasing the Basic Allotment, which benefits all districts. Legislators could also give school districts relief by allowing them to receive a discount for paying recapture early in the year. The state gives similar discounts to corporate taxpayers who pay franchise taxes early.