KEY POINTS TO REMEMBER:

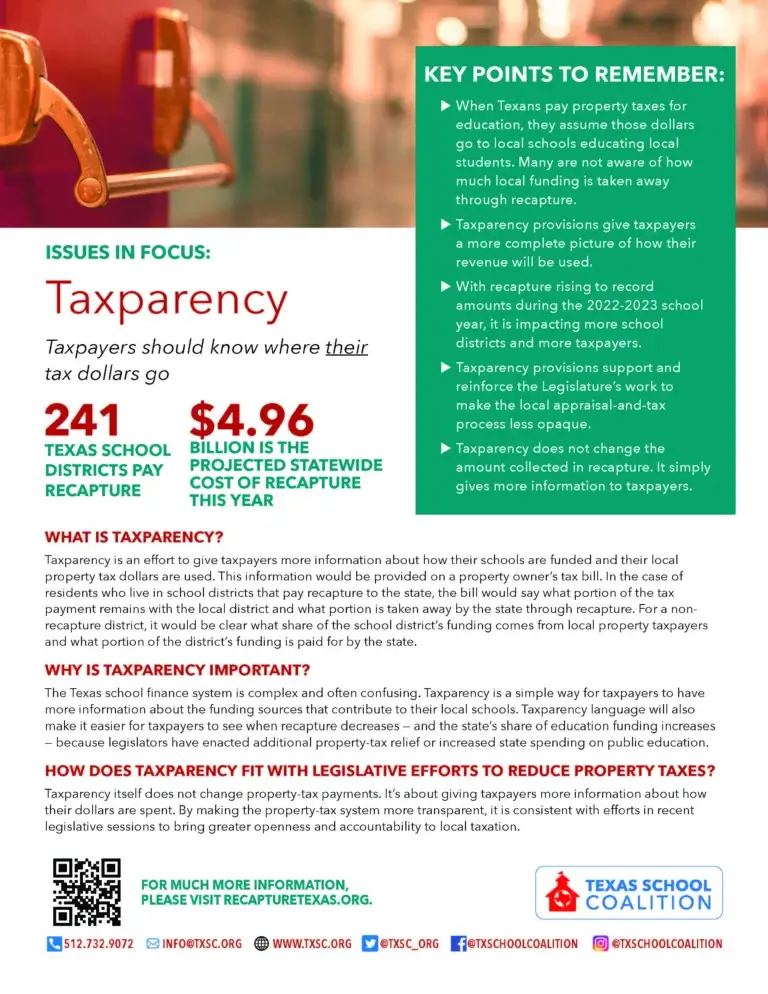

- When Texans pay property taxes for education, they assume those dollars go to local schools educating local students. Many are not aware of how much local funding is taken away through recapture.

- Taxparency provisions give taxpayers a more complete picture of how their revenue will be used.

- With recapture rising to record amounts during the 2022-2023 school year, it is impacting more school districts and more taxpayers.

- Taxparency provisions support and reinforce the Legislature’s work to make the local appraisal-and-tax process less opaque.

- Taxparency does not change the amount collected in recapture. It simply gives more information to taxpayers.

WHAT IS TAXPARENCY?

Taxparency is an effort to give taxpayers more information about how their schools are funded and their local property tax dollars are used. This information would be provided on a property owner’s tax bill. In the case of residents who live in school districts that pay recapture to the state, the bill would say what portion of the tax payment remains with the local district and what portion is taken away by the state through recapture. For a non-recapture district, it would be clear what share of the school district’s funding comes from local property taxpayers and what portion of the district’s funding is paid for by the state.

WHY IS TAXPARENCY IMPORTANT?

The Texas school finance system is complex and often confusing. Taxparency is a simple way for taxpayers to have more information about the funding sources that contribute to their local schools. Taxparency language will also make it easier for taxpayers to see when recapture decreases — and the state’s share of education funding increases — because legislators have enacted additional property-tax relief or increased state spending on public education.

HOW DOES TAXPARENCY FIT WITH LEGISLATIVE EFFORTS TO REDUCE PROPERTY TAXES?

Taxparency itself does not change property-tax payments. It’s about giving taxpayers more information about how their dollars are spent. By making the property-tax system more transparent, it is consistent with efforts in recent legislative sessions to bring greater openness and accountability to local taxation.