News & Updates

Bender named Executive Director of Texas School Coalition

Education savings accounts will force taxpayers to subsidize private schools that are not required to follow student safety guidelines, do not adhere to federal protections for students in special education, and are not transparent with their use of public dollars.

ESAs would force taxpayers to subsidize private schools

Education savings accounts will force taxpayers to subsidize private schools that are not required to follow student safety guidelines, do not adhere to federal protections for students in special education, and are not transparent with their use of public dollars.

Vouchers are not the answer for Texas students

A new report from the House Select Committee on Educational Opportunity and Enrichment provides recommendations on a number of issues related to education policy in Texas. The report includes discussion of a voucher program that would allow families to use taxpayer dollars to attend private or home schools.

Tax bills reduce Robin Hood but classrooms are left in need of support

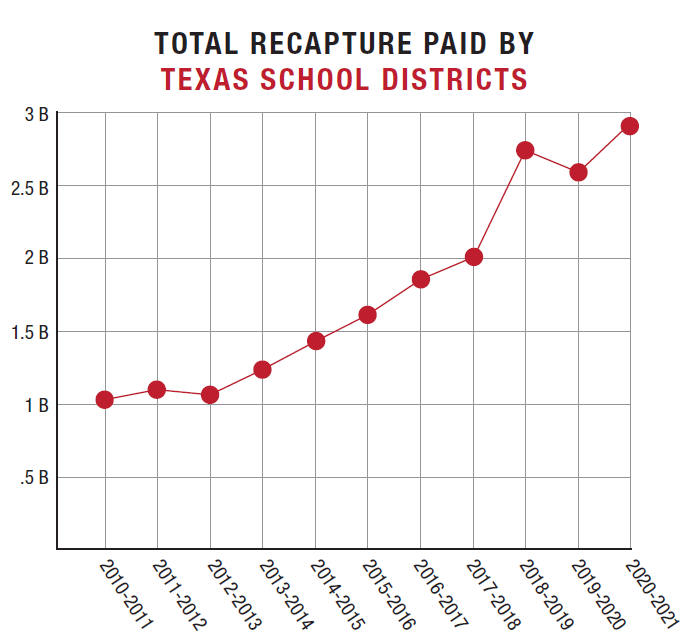

The property-tax legislation signed into law will help achieve a very important objective: It will reduce the amount of recapture paid by Texas taxpayers by 41 percent. There needs to be a balance between tax relief and more dollars for the classroom. Unfortunately, legislators have only completed half the job.

Testimony for House Select Committee on Educational Opportunity & Enrichment

The Coalition offered testimony to the newly-appointed committee speaking to the rising costs of education, the different circumstances various districts face, the need to avoid funding cuts, and the need for public accountability for public funds.

Educators praise bipartisan coalition for steadfastly supporting public schools

Teachers, parents, administrators, school board trustees and others supporting public education expressed gratitude Monday to the bipartisan coalition in the Texas House who stood strong against Education Savings Account (ESA) vouchers for private schools throughout this year’s legislative session.

Senate’s latest voucher bid is a losing bargain for Texas students and teachers

The Texas School Coalition testified Monday against the Texas Senate’s version of House Bill 100. The new Senate plan seeks to incorporate private-school vouchers into legislation that was otherwise meant to improve the state’s school finance system.

Senate inaction on Basic Allotment would put Texas schools further behind

With just over a week left in the legislative session and key deadlines fast approaching, educators are concerned that the opportunity for robust, needed investments in public education is slipping away.

Legislators should balance property-tax relief with investments in students

Dollars spent on property-tax relief are not investments in public education. Those dollars do not reach classrooms and they do not give schools more money to pay teachers and meet other needs.

HB 100 – School Finance Testimony

The Coalition provided testimony to the House Public Education Committee for House Bill 100, which increases the Basic Allotment, requires a teacher pay increase, and makes other changes to the school finance formulas.

Testimony on School Safety Legislation

The Coalition provided testimony to legislative committees in both chambers regarding bills calling for increased funding for school safety.

SB 9 Teacher Pay Raise Testimony

The Coalition provided testimony to the Senate Education Committee on Senate Bill 9, which relates to an across-the-board pay raise for teachers, nurses, counselors, and librarians.

Senate Property Tax Relief Testimony

The Coalition provided testimony to the Senate Finance Committee regarding Senate Bill 3 & Senate Bill 4, which are both measures proposing property tax relief.

HB 2 (Property Tax Relief) Testimony

The Coalition provided testimony to the House Ways & Means Committee regarding House Bill 2, the measure proposing property tax relief.

House Appropriations Subcommittee on Article III Testimony – HB 1

The Coalition provided testimony to the House Appropriations Subcommittee on Article III (Education) regarding the state budget, pointing out that recapture has reached nearly $5 billion per year and schools need help meeting the increased costs caused by a 14.5% rate of inflation.

Senate Finance Committee Testimony – SB 1

The Coalition provided testimony to the Senate Finance Committee on the state budget, pointing out that recapture has reached nearly $5 billion per year and schools need help meeting the increased costs caused by a 14.5% rate of inflation.

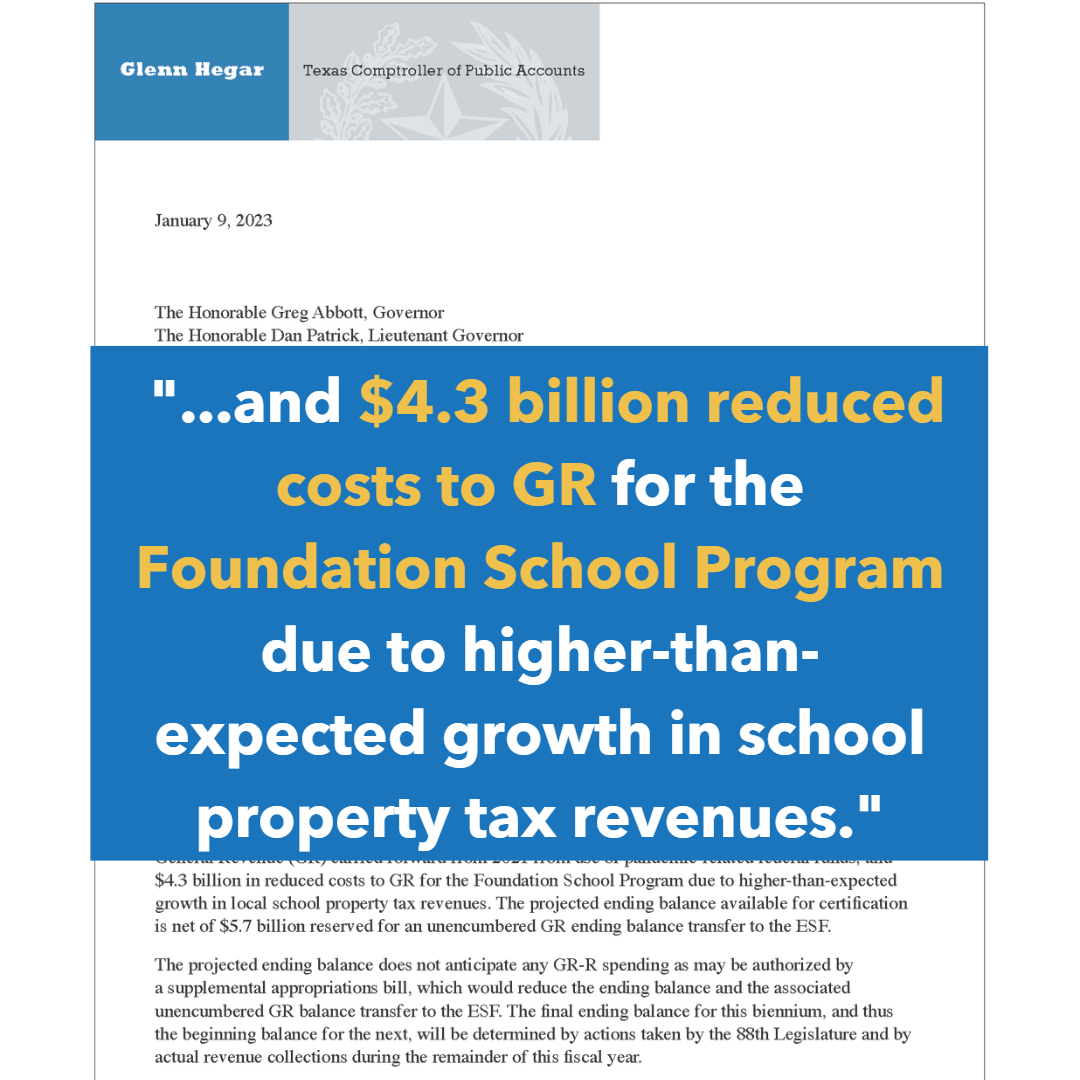

New Robin Hood figure shows enormous burden put on schools, homeowners

The Biennial Revenue Estimate from Comptroller Glenn Hegar states that recapture is expected to reach nearly $5 billion during Fiscal Year 2023.

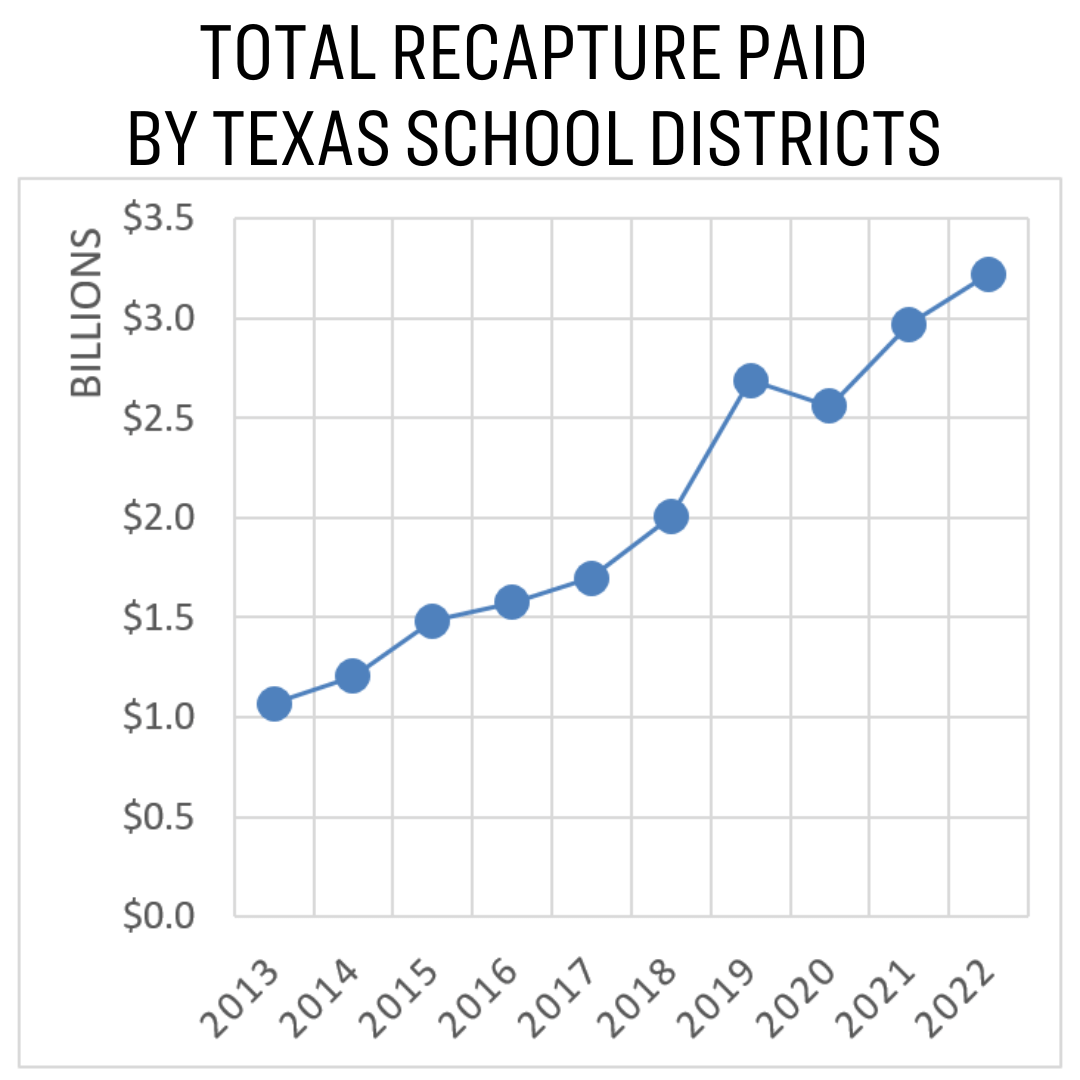

Texas Removes Record Robin Hood Revenue from School Districts

The state took $3.2 billion in local taxpayer funding out of school districts during the past year through Robin Hood recapture. This record-high amount of recapture came as school districts struggled to fully staff campuses and battled cost increases driven by high inflation.

School Finance testimony in House

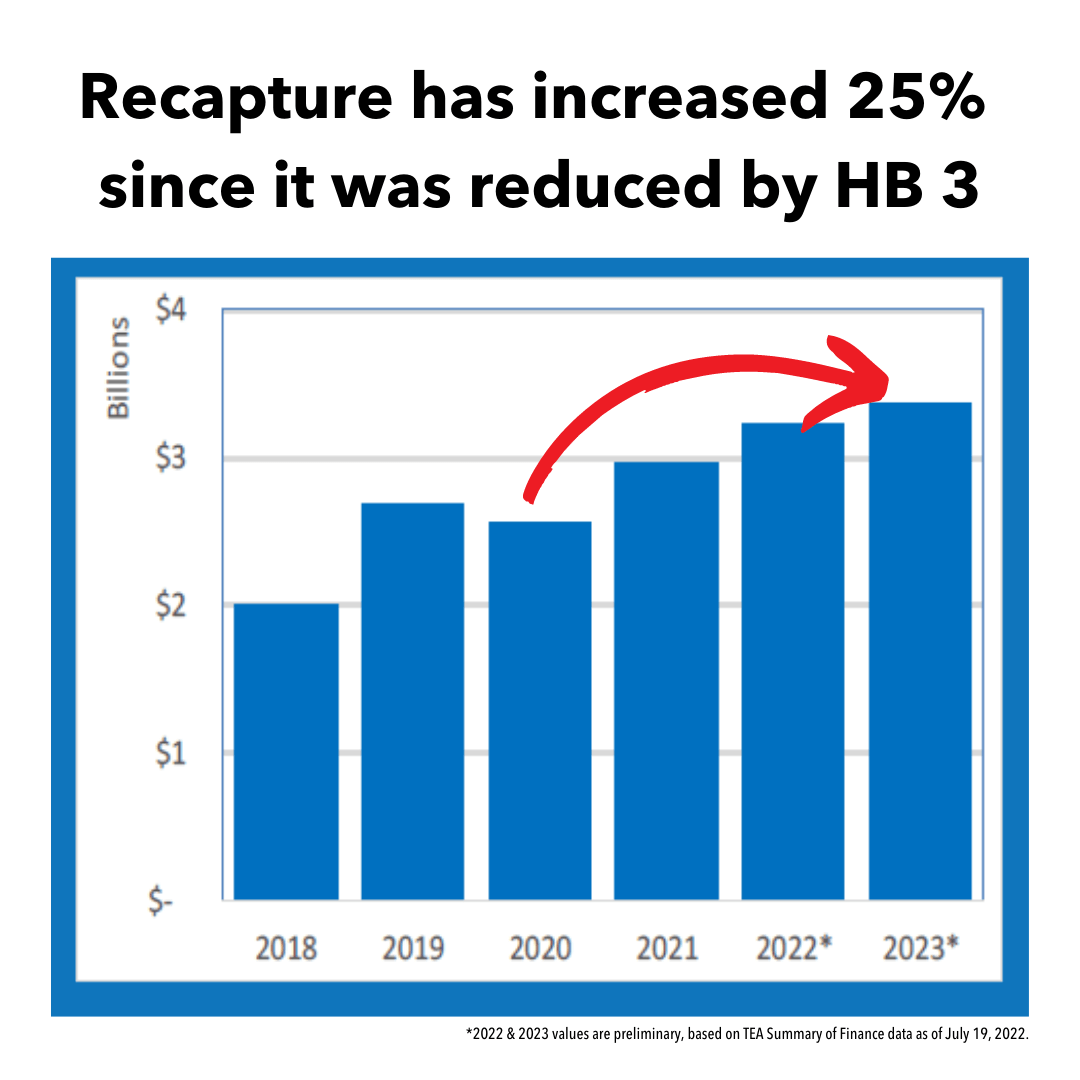

The Coalition provided testimony to the House Public Education Committee on school finance. Since HB 3, inflation has increased by 12%, while school funding has been flat. Since recapture was reduced by HB 3, it has increased by 25%.

As state surpluses surge, schools struggle with rising costs

Statement from Christy Rome, Executive Director of the Texas School Coalition, concerning the revised estimate of a state surplus and the funding needs of public schools.

School Finance testimony in Senate

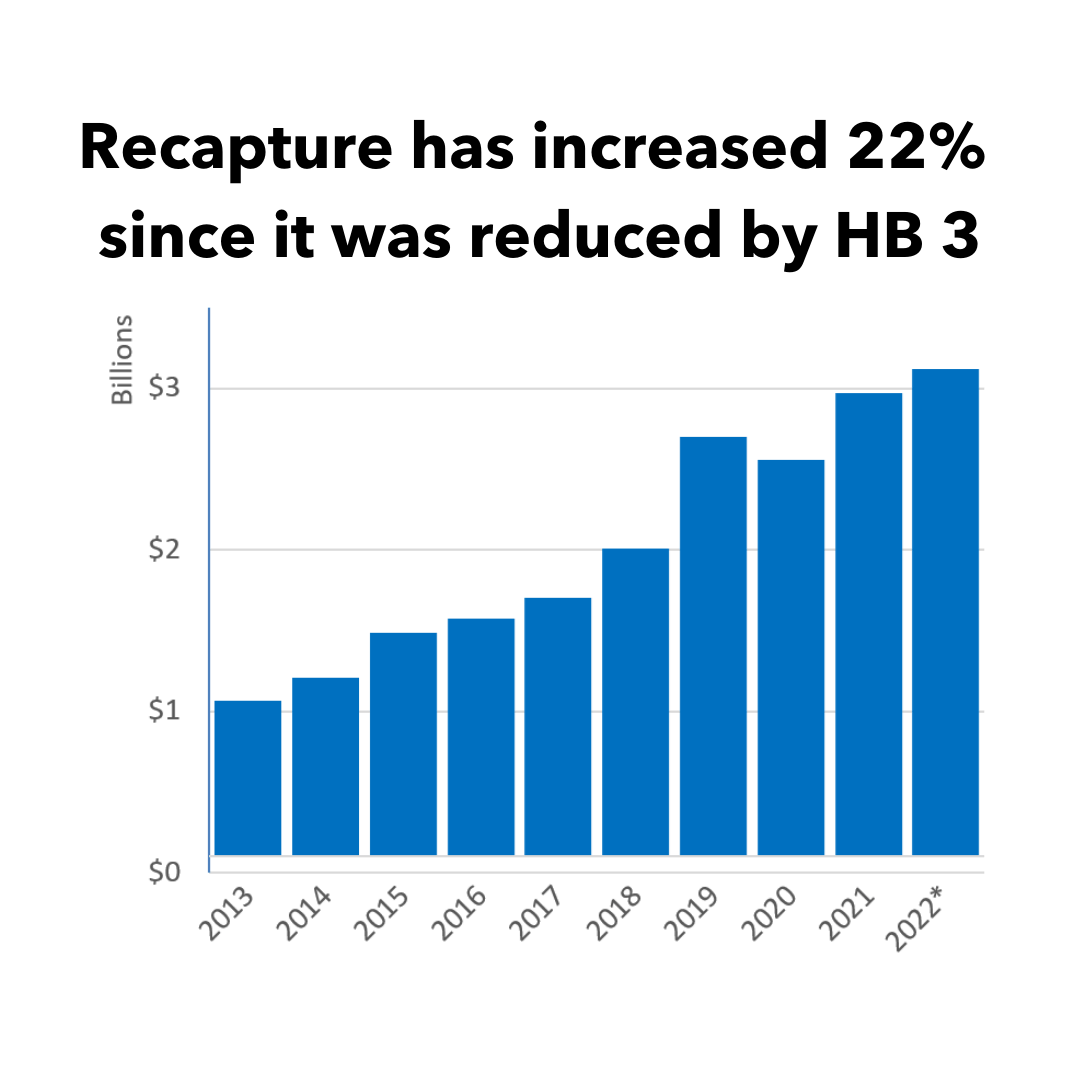

The Coalition provided testimony to the Senate Education Committee on school finance. Since HB 3, inflation has increased by 9%, while school funding has been flat. Since recapture was reduced by HB 3, it has increased by 22%.

Balanced, measured approach needed for tax relief

The Coalition provided testimony to the Senate Finance Committee on property tax relief. Limitations to relief mean some taxpayers are paying more, while schools are not beneficiaries of the increased payments. Schools do not receive automatic increases, and a balanced approach is needed.

Inflationary Costs Impact Schools

The Coalition provided testimony to the Senate Finance Committee as they studied the impact of inflation on state and local governments. Schools are struggling to keep up with inflationary costs and to attract and retain a highly qualified teaching workforce.

March 2022 Primary Election Results

Texas voters had their say in the March 2022 Primary Election. While more than 25% of those registered to vote cast ballots in the 2020 Presidential Primary, only 17.3% of registered voters cast ballots in this Midterm Primary.

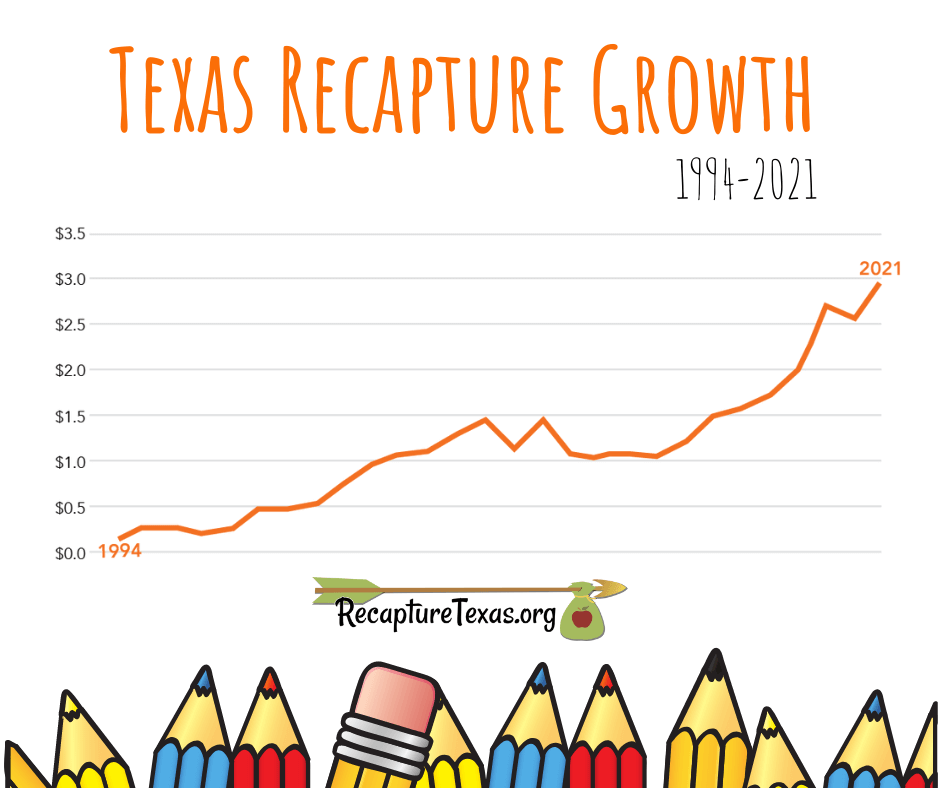

State’s Reliance on Local Dollars to Balance Budget

The State of Texas is increasingly and alarmingly removing local property tax dollars from school districts through the process of recapture, the Texas School Coalition explains in a newly released report.

Testimony on SB 1

The Texas Senate is seeking to provide taxpayers with additional property tax relief, but only on a temporary basis. The legislature must make sustainable investments in tax relief and in our schools.

Recapture Takes Nearly $3 Billion From Local Schools

Texas school districts must send nearly $3 billion in local taxpayer funding to the state by Sunday under the state’s school finance law — a record amount that puts a crushing burden on taxpayers throughout the state while taking needed dollars away from their local schools.

House Bill 1525 – 2021 School Finance Legislation

The school finance bill of the 2021 legislative session is on its way to the Governor. Find all the details on the wins and losses for students and schools here.

CSHB 1525 Limits Local Funding

The Texas Senate’s Committee Substitute for HB 1525 includes a limitation for how much local funding school district are allowed to spend on students. The bill requires that schools reserve…