As state surpluses surge, schools struggle with rising costs

Statement from Christy Rome, Executive Director of the Texas School Coalition, concerning the revised estimate of a state surplus and the funding needs of public schools.

School Finance testimony in Senate

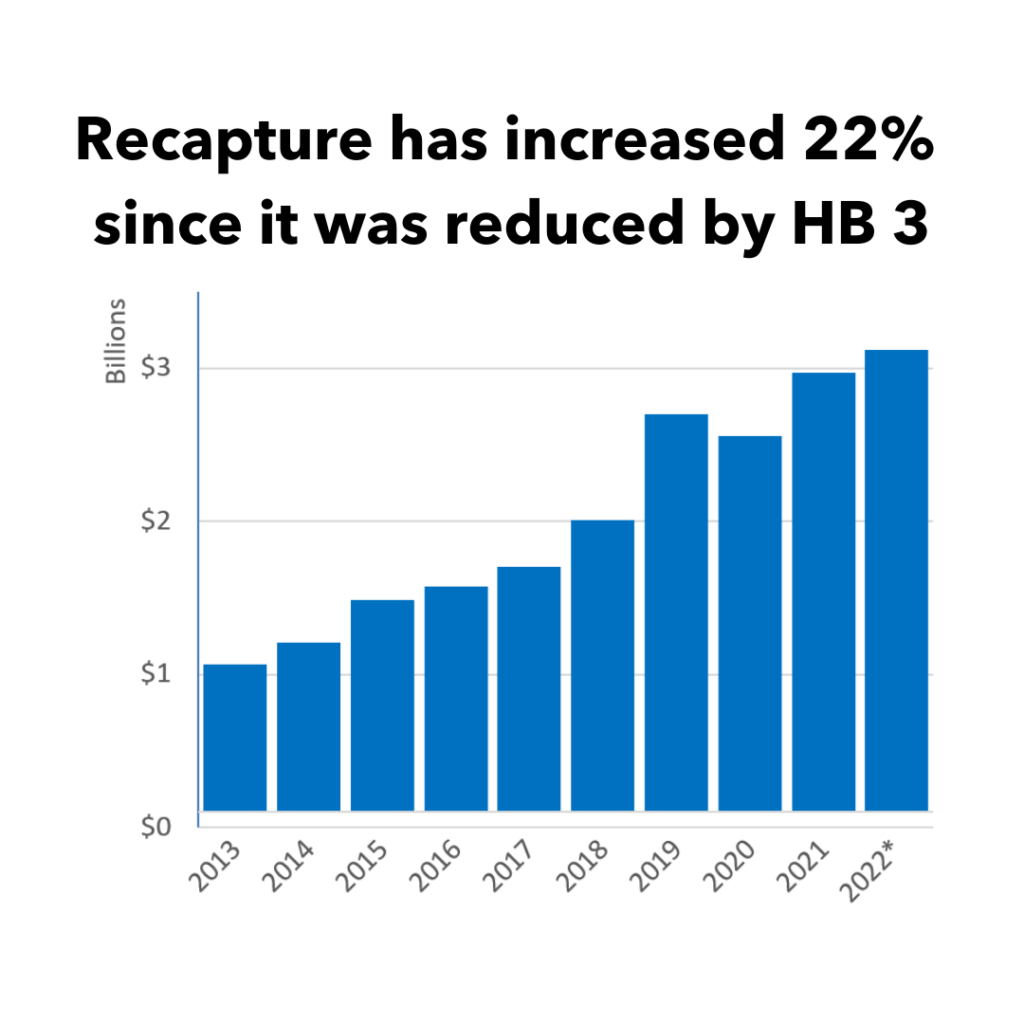

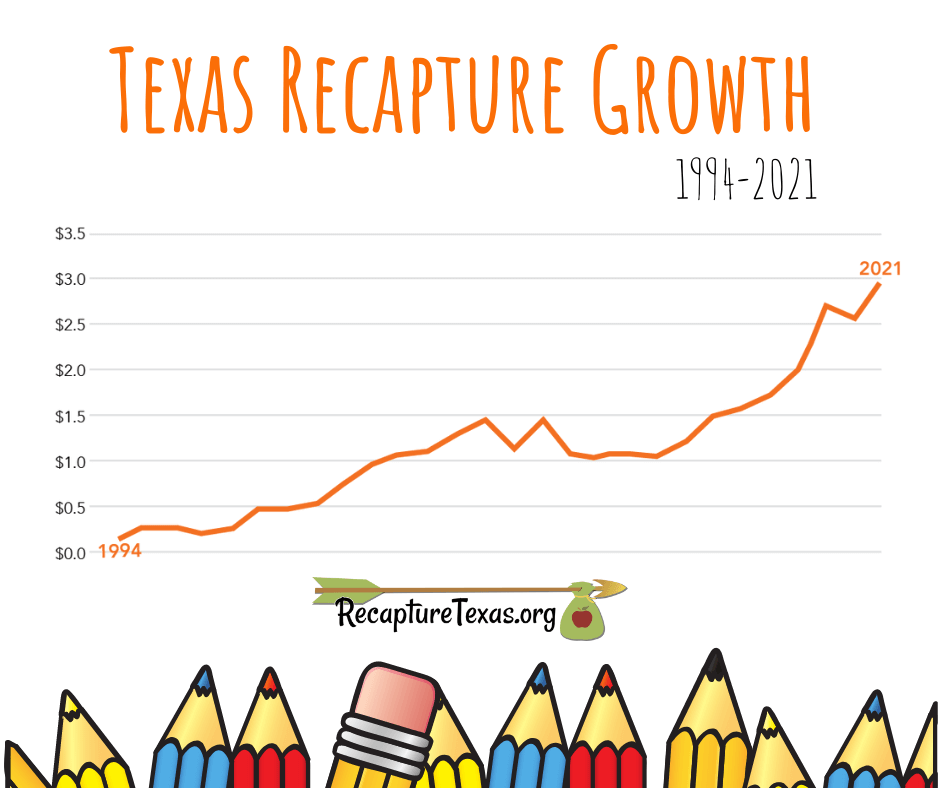

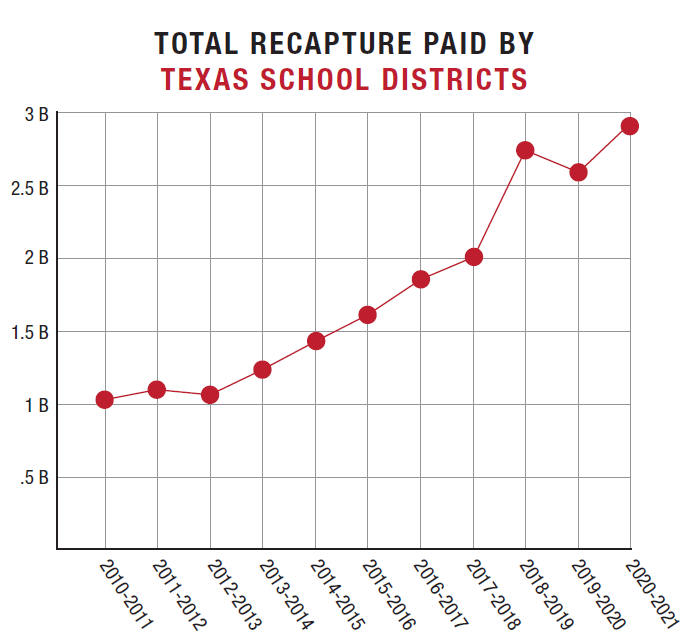

The Coalition provided testimony to the Senate Education Committee on school finance. Since HB 3, inflation has increased by 9%, while school funding has been flat. Since recapture was reduced by HB 3, it has increased by 22%.

Balanced, measured approach needed for tax relief

The Coalition provided testimony to the Senate Finance Committee on property tax relief. Limitations to relief mean some taxpayers are paying more, while schools are not beneficiaries of the increased payments. Schools do not receive automatic increases, and a balanced approach is needed.

Inflationary Costs Impact Schools

The Coalition provided testimony to the Senate Finance Committee as they studied the impact of inflation on state and local governments. Schools are struggling to keep up with inflationary costs and to attract and retain a highly qualified teaching workforce.

School Funding Still in Need of Improvement

Some people have recently tried to downplay the impact of recapture on schools and taxpayers by saying the State and the federal government have already made sizable investments to help our schools. These points are recommended to provide some important context and facts.

State’s Reliance on Local Dollars to Balance Budget

The State of Texas is increasingly and alarmingly removing local property tax dollars from school districts through the process of recapture, the Texas School Coalition explains in a newly released report.

Testimony on SB 1

The Texas Senate is seeking to provide taxpayers with additional property tax relief, but only on a temporary basis. The legislature must make sustainable investments in tax relief and in our schools.

Recapture Takes Nearly $3 Billion From Local Schools

Texas school districts must send nearly $3 billion in local taxpayer funding to the state by Sunday under the state’s school finance law — a record amount that puts a crushing burden on taxpayers throughout the state while taking needed dollars away from their local schools.

CSHB 1525 Threatens Funding for Public Schools

House Bill 1525 is billed as the “clean up” measure that addresses unintended consequences of school finance reforms passed in 2019. However, the Senate version of HB 1525 goes much further and could lead to funding reductions for many school districts. It would also severely limit districts’ ability to use federal education funds as intended.

Formula Transition Grant Prevents Funding Losses

The House Bill 3 school finance legislation passed in 2019 invested billions of new dollars in public education, but the new law’s changes to funding formulas left some districts with less funding. The Legislature put Formula Transition Grants in place to ensure districts received a minimum increase. FTGs make the law adopted in 2019 better than the law we had before; without it (or with it at a reduced amount), that isn’t the case.