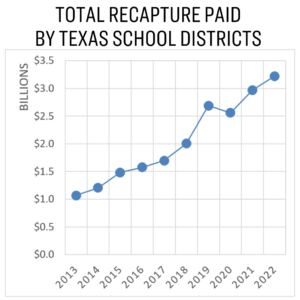

The state took $3.2 billion in local taxpayer funding out of school districts during the past year through Robin Hood recapture. This record-high amount of recapture came as school districts struggled to fully staff campuses and battled cost increases driven by high inflation.

Monday is the last day for school districts to make their recapture payments to the state for the 2021-22 school year, and for the first time, the total amount paid statewide will exceed $3 billion.

Recapture is the process by which the state removes local tax dollars from districts with relatively high amounts of property wealth per student. The increase in recapture reflects the fact that property values have risen significantly across the state and those increases in local tax payments have not been offset by additional state funding for public education.

“Robin Hood recapture removes billions of dollars in local funding from Texas school districts,” said Kyle Lynch, Superintendent of Seminole ISD and President of the Texas School Coalition, which represents recapture-paying districts. “School districts are watching their recapture payments increase at a time when state funding is not keeping up with higher costs for salaries, fuel and utilities.”

When the Legislature created recapture in 1993, it affected only a handful of the state’s wealthiest school districts. In 2021-22, 158 school districts educating more than 1 million students were forced to pay recapture. Many of the students in recapture-paying districts are classified as “economically disadvantaged” due to their low family income.

In 2019, the Legislature enacted House Bill 3, which guaranteed a 3% funding increase for all school districts. Since that time, however, inflation has driven costs 12% higher.

“While state coffers are overflowing with surpluses, Texas school districts have real and growing needs,” said Dr. Theresa Williams, Superintendent of Plano ISD. “Right now, as property values push tax payments higher, the state is reducing the amount of money that it invests in public education. Additional state investments in public education would help slow the growth of recapture and benefit all schools.”

State law gives school districts little choice but to collect local taxes for recapture. Districts that seek to lower their tax rate to reduce recapture must still make those payments to the state, leaving them with less revenue for teacher salaries and other local costs.

Along with new state investments in public education, the Texas School Coalition has also called for the Legislature to give districts a discount on their recapture payments if they make those payments early in the year — similar to discounts that businesses receive for paying other taxes early.

“Taxpayers are frustrated at the amount of money that recapture is removing from local school districts,” said Dr. Angelica Ramsey, Superintendent of Midland ISD. “Without real reform, the amount paid in recapture will only continue to grow.”

###