As recapture has increased dramatically, funding for schools has not. When a taxpayer sends a higher amount of taxes to their local school district, they understandably expect that their school district will have a higher amount of revenue. However, in a recapture district, that higher tax payment means that the district will make a larger recapture payment to the state. And in a non-recapture district, it means the state will send less money to support that district, since local tax dollars will account for a larger share of the district’s’ overall revenue.

The shell game occurs through the supplemental appropriations act. Lawmakers adopt a two-year budget every legislative session.

Then they also adopt a supplemental appropriations act to settle-up the finances from the previous biennium. The trend we’ve seen emerge is that lawmakers adopt a budget with estimates for recapture (which is a funding source for the state) that are significantly lower than the actual amounts turn out to be.

When that happens, and far more recapture is collected than was expected, the bottom line for schools does not change. Funding entitlements for schools remain the same. And those who paid more in property taxes than expected don’t get any of their money back.

Where does the money go? The excess in recapture payments adds to the state’s funding surplus. The higher-than-expected collections don’t translate to a change in school funding, but rather a shift in the method of finance used to fund schools. The state no longer has to contribute as much from its own General Revenue (which is primarily funded by sales tax), so the difference from the higher amount of recapture is returned to the state’s General Revenue, which legislators are free to spend however they see fit.

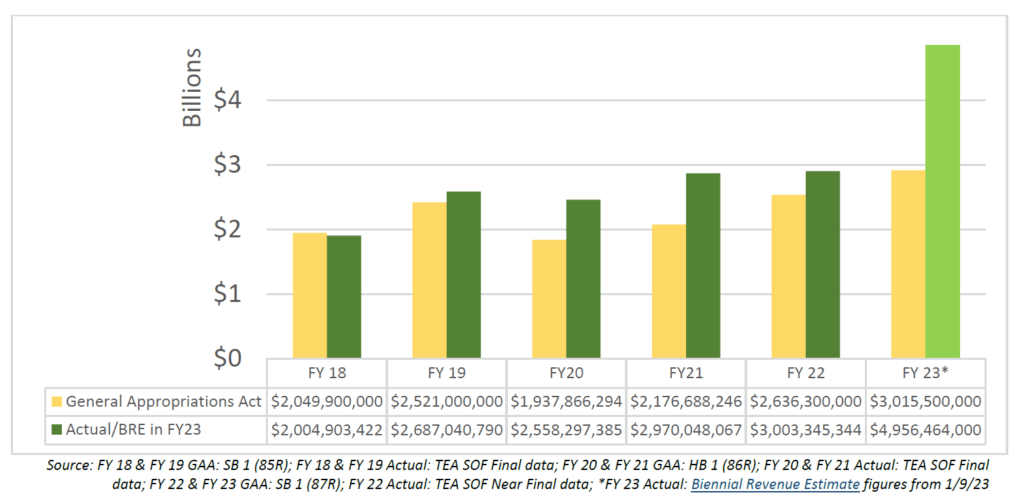

Here are the actual numbers comparing the amount the General Appropriations Acts estimated would be collected in recapture, compared to the actual numbers for recapture as reported by the Texas Education Agency Summary of Finance data:

The state returned $121K to GR for higher-than-expected recapture in 2019. Then in 2021, the state recognized a $1.4 billion savings due to recapture, and according to the estimates from the Comptroller, the state could be looking at more than $2 billion in savings due to higher-than-expected recapture in 2023.

This isn’t an issue that only impacts recapture districts, either. The shell game applies to all schools under the Foundation School Program (FSP). After lawmakers, school leaders, and parents celebrated the passage of HB 3 in 2019, which invested an additional $11.6 billion into schools (a combination of investments in tax relief and funding for classrooms), the supplemental appropriations act adopted in 2021 reduced funding for the FSP for the 20-21 biennium by $5.2 billion. So the $11.6 billion investment was actually a $6.4 billion investment in tax relief and classrooms. The $1.4 billion savings from recapture was part of that $5.2 billion.

And the $2 billion in increased recapture is part of the $8.2 billion reduction in funding for the Foundation School Program proposed in Senate Bill 30 during the 88th Legislative Session. That’s $8.2 billion that was appropriated for the support of public schools in 2021 that will now generate a state savings that contributes to the overall state surplus rather than being spent for the purpose of public education. (More info from the Legislative Budget Board on SB 30 here.)